We’re excited to announce that our new installation method of installing MLFinlab, which utilizes Docker, is now available in open beta.

Our foundational offering, MLFinLab, is a shining beacon of our dedication, encapsulating an advanced Python library flush with production-grade algorithms plucked from prestigious academic journals and progressive textbooks. Designed for discerning portfolio managers and traders, it offers an unparalleled suite of intuitive, interpretable, and actionable tools.

We previously announced the closed beta phase for our Dockerized version of MLFinLab, aiming to make the MLFinLab experience even smoother. Today, we’re taking another major step forward.

The beta is now open to all subscribers

We’re thrilled to announce that the Docker for MLFinLab beta is now open to everyone with a valid MLFinLab subscription. Our aim has always been to deliver top-notch service, and in line with that, we want to expand the Dockerized experience to our larger community.

Why Docker? A quick refresher 🐳

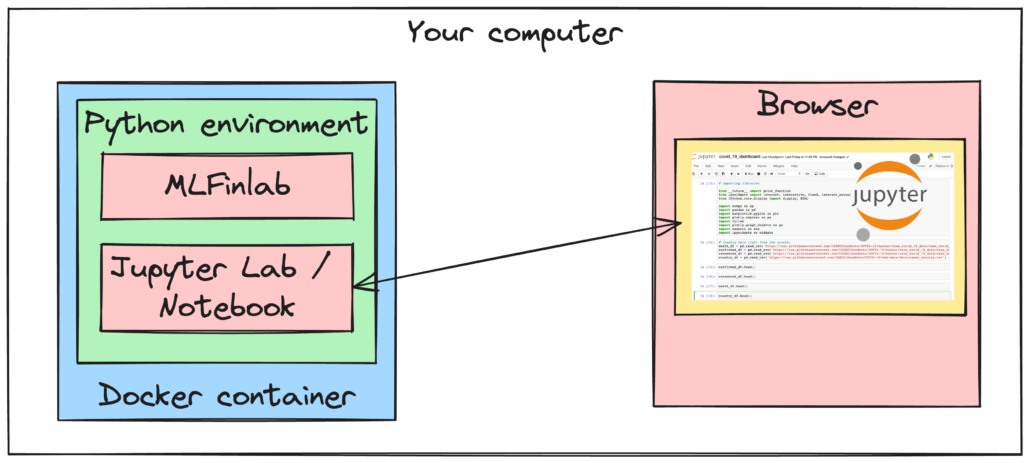

Python, while robust, sometimes presents the challenges of dependency management, famously known as the “Python dependency hell”. With the Dockerized version of MLFinLab, you’re empowered to bypass these challenges. Docker ensures that MLFinLab and all its requisite dependencies are wrapped into a consistent, deployable unit. This not only ensures cross-platform consistency but also guarantees a hassle-free user experience, devoid of conflicts and system-specific quirks.

What to expect from this experience?

Gone are the days of manually configuring Python environments and wrestling with pip installations. The Dockerized MLFinLab is all about automation and simplicity:

- Pull: Retrieve a Docker image replete with every dependency you’ll need.

- Authenticate: As the container springs to life, your API key is validated.

- Initiate: MLFinLab is installed effortlessly within the container.

- Launch: Dive straight into a ready-to-use Jupyter Lab or Notebook instance.

Best of all, these steps are automatically taken care of for you with our mlfinlab-quickstart project, which gets you up and running with the Dockerized version of MLFinlab in a matter of seconds.

This entire operation is neatly compartmentalized within the Docker container, ensuring zero interference with your main system. It’s an evolved, streamlined approach to MLFinLab installation that we’re confident you’ll appreciate.

Your role in this journey

By opening the beta to our subscribers, we’re emphasizing our belief in community-driven development. Your feedback and insights will be foundational in shaping the Dockerized MLFinLab’s trajectory, leading it towards perfection.

If you’re an MLFinLab subscriber, seize this moment. Dive into our beta testing phase and be an influential part of MLFinLab’s evolution. Your feedback is not just welcomed—it’s essential.

For our subscribers ready to embark on this journey, installation instructions are available via the official MLFinlab documentation, which is accessible via the Portal. Here’s to innovation, collaboration, and the next chapter in the MLFinLab saga.